* * *

* * *

* * *

* * * * * *

* * * * * *

* * *

* * * New Jersey To Now Tax Water Supply as Well – Creative Greed of Taxes | Armstrong Economics

* * * New Jersey To Now Tax Water Supply as Well – Creative Greed of Taxes | Armstrong Economics

* * *

* * *

* * *

* * *

* * *

* * *

* * *

* * *

* * *

* * *

* * *

* * *

* * *

* * *

* * *

* * *

* * *

* * *

* * *

* * *

* * *

* * *

* * *

* * *

* * * *

* * * *

* * *

* * *

* * *

* * *

* * *

* * *

* * *

* * *

* * *

* * *

* * *

* * *

* * *

* * *

* * *

* * *

* * *

|

|||||||||||||||||||||||||||

| |||||||||||||||||||||||||||

* * *

| Russian scandal widens | ||||||||||||||||||||||

|

Manhattan D.A., Russian government joins growing list of investigators | |||||||||||||||||||||

|

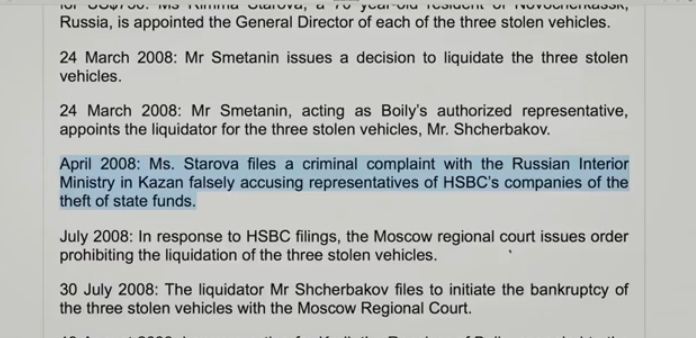

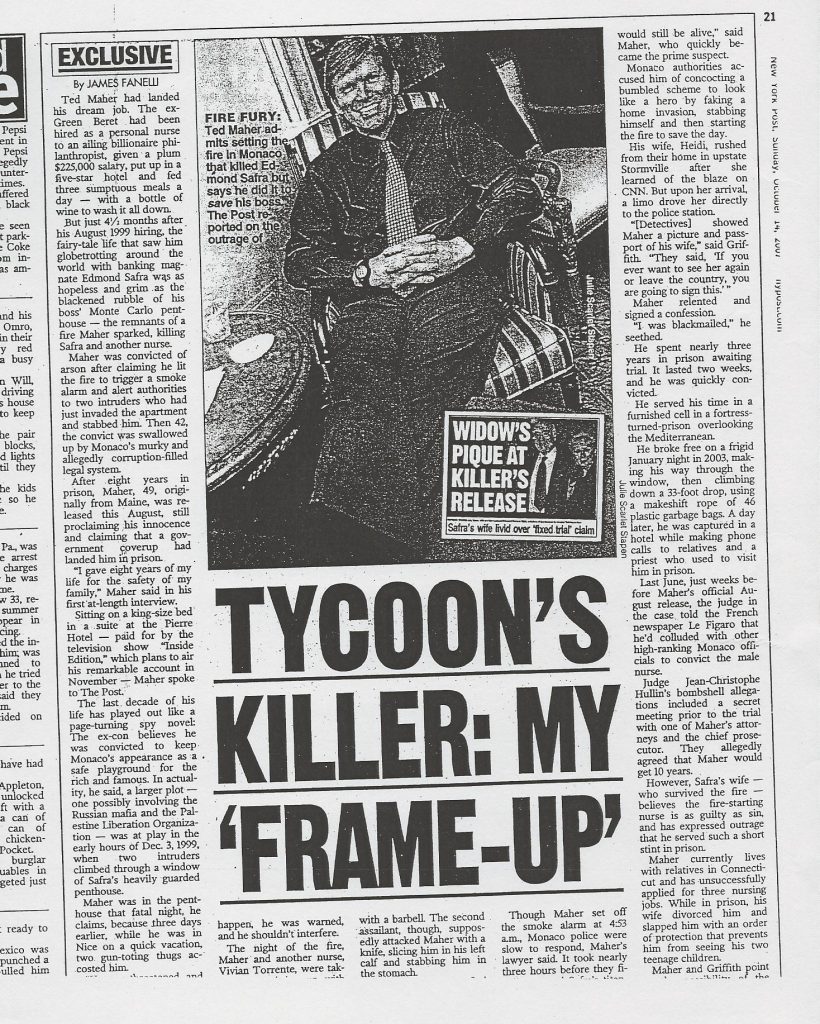

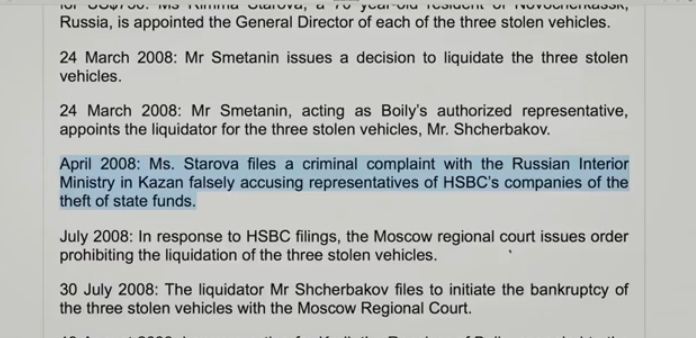

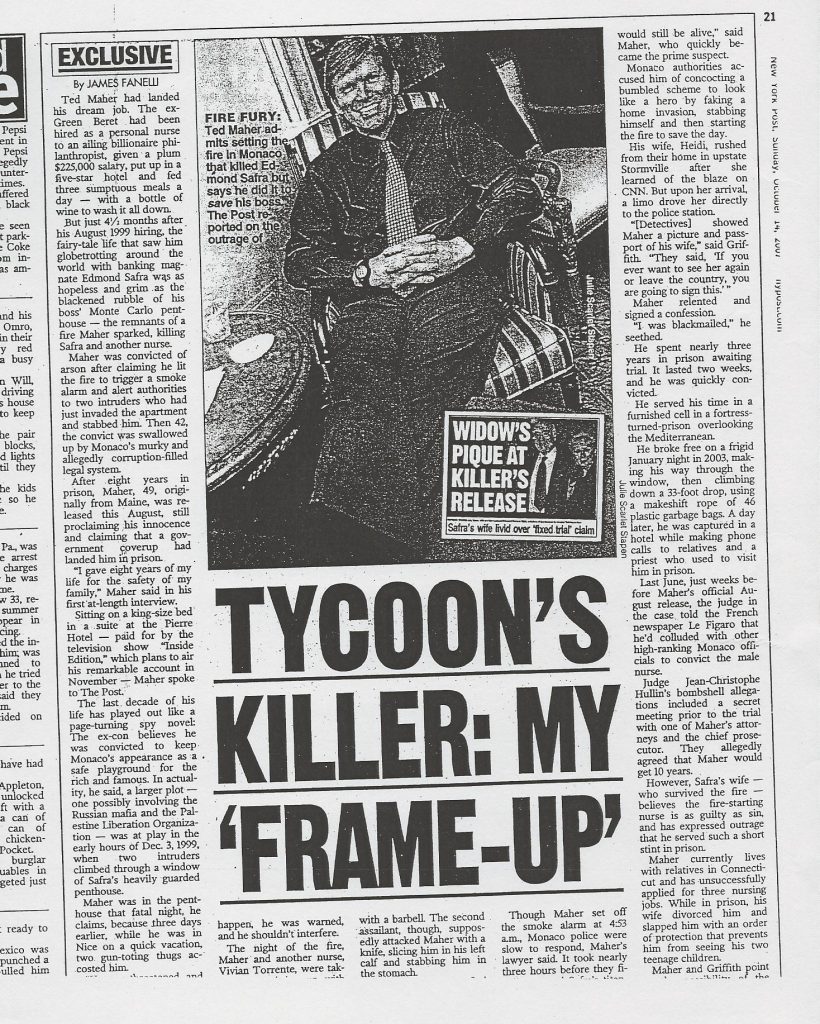

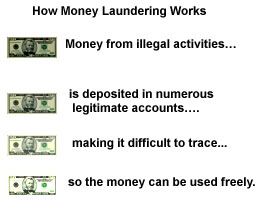

A week ago, allegations arose that a Russian crime syndicate had laundered some $10 billion - possibly funds diverted from International Monetary Fund payments - through accounts at the Bank of New York (BK) and Republic National Bank (RNB). From there, more details of money laundering and mobsters have surfaced, prompting officials in the Washington to call for Congressional hearings. The New York Times first reported the story last Thursday. To delve to the bottom of the alleged money laundering operations, a wide array of government and regulatory agencies from at least three different countries are launching a full-blown investigation into the matter - with the cooperation of the U.S. banks involved, according to sources familiar with the situation.  That list of investigators widened Thursday to include the New York U.S. District Attorney's office as well as the Russian government. The Federal Bureau of Investigation, the British government and the International Monetary Fund are also part of the probe. "We are completely cooperating with authorities," said Frank Scarangella, a spokesman for the Bank of New York. There have been no allegations at all of the Bank of New York's involvement." According to published reports in the Wall Street Journal and USA Today, the story began in 1994 when Russia's IMF representative, Konstantin Kagalovsky, left the organization to join the Menatep Bank in Moscow. Over the next three years, it's alleged, Kagalovsky arranged to funnel billions of IMF money meant to help fix Russia's financial woes through a private company called Benex Worldwide Ltd. and eventually into and back out of the two New York-based banks. In 1998, Republic Bank alerted authorities about unusually large wire transfers coming through its coffers from Russia. From that point, British and U.S. law enforcement officials monitored the ebb and flow of cash through both banks, including monitoring an account specifically held open at their request. "There was an account, not in the name of Benex, that was opened at Republic National Bank, and it has remained open at the specific written request of U.S. authorities," said spokeswoman Melissa Krantz. "We have been cooperating with U.S. law enforcement officials for some time. We were the ones who filed the report that initially triggered them onto this," she said. As for Bank of New York, it has suspended two executives - Natasha Gurfinkel Kagalovsky and Lucy Edwards - both of whom worked for the bank's Eastern European division. Konstantin Kagalovsky is Ms. Kagalovsky's husband. Other key players in the ever-widening saga include Peter Berlin, the husband of Ms. Edwards who opened Benex-related accounts at the Bank of New York and Semion Mogilevitch, an alleged Russian money launderer who at one point was suspected of channeling funds through YBM Magnex International Inc., a now-defunct industrial magnet producer whose shares were listed on the Toronto Stock Exchange, according to the Journal. Money laundering typically involves taking large cash deposits from individuals or businesses when the money is either suspected or known to have been obtained from illegal activities or for illicit purposes. The Bank Secrecy Act requires all U.S. banks to report cash deposits of $10,000 or more, as does the Money Laundering Act of 1986. With all the accusations and suggestions focusing on Russia, at least one U.S. lawmaker suggested that, if money has been stolen, IMF loan payments to Russia should be suspended. Russia said on Wednesday it expects to receive the next $640 million installment of a $4.5 billion IMF package. "Clearly the loan payment shouldn't go out if it's going to be handled the way the past has been handled," said House of Representatives Banking Committee Chairman Jim Leach. "If money is to be stolen it shouldn't be transferred." The House Banking Committee plans to hold hearings next month to explore the impact on U.S. banks of money laundering and on international financial corruption. For its part, the IMF has opted to downplay its role in the sordid tale. Repeating a statement prepared by the IMF on Monday, spokesman William Murray said "the allegations of money laundering in Russia are extremely serious and we are looking further into the matter." --from staff and wire reports | ||||||||||||||||||||||

* * *

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.